There’s more to buying a house than just the purchase price. Closing costs can add up quickly if you’re not prepared for them. Some of these can be included in your mortgage, which helps to remove the sting somewhat. Others must be paid upfront before you can take possession.

Since closing costs can be significant, it pays to know what you’re up against when creating your home buying budget. Our team of experienced real estate agents are here to help prepare our buyers in Guelph and the Tri-Cities close their transactions seamlessly and successfully. This guide will also help you know what to expect.

Land Transfer Taxes

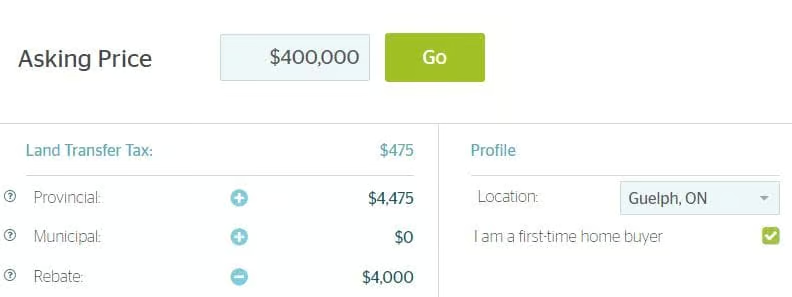

First of all, the provincial land transfer tax is one of the most significant closing costs which you can not roll into your mortgage. The amount of tax depends on the value of the home. On average, it usually ends up being 1-1.5% of the total purchase price.

Land transfer taxes can seem like a heavy burden, but there are two pieces of good news for home buyers in the Guelph region. Unlike Toronto, we do not have an additional municipal land transfer tax that essentially doubles the expense. Secondly, first home buyers have some relief. If you currently do not own or have a stake in a house, you can qualify for up to $4,000 off of your land transfer tax. Depending on the purchase price, this might be enough to cover almost the whole amount!

Example: Let’s say you’re a first time home buyer looking at a $400,000 condo. The land transfer taxes would normally be $4,475 out of your pocket. However, with the $4,000 rebate, you will only have to pay $475. That is a massive amount of savings that helps to make your initial purchase far more affordable. Once you’ve been in the market for a while, you’ll begin to build equity that could empower you to upgrade to a larger home later.

Should you consider real estate as an investment? The posts below can help:

- Benefits of Buying a Student Rental

- What Are the Clauses on a Lease?

- Is Buying an Income Property Still Worth It for Small Investors?

Other Closing Costs and Miscellaneous Expenses

Legal fees are another closing cost that you’ll need to account for. Your real estate lawyer will run a title search to ensure the property is free of any encumbrances—like liens, errors, or ownership disputes—that could interfere with the transfer of ownership. Title insurance adds an extra layer of protection, covering you against issues that may not show up in the initial search, such as title fraud, zoning violations, or undisclosed debts from previous owners. While legal costs can total approximately $1,400 on closing, we’ll cover the cost of your title insurance when you purchase a home with us, saving you a few hundred dollars and giving you added peace of mind.

Another of the most common closing costs when buying a home is mortgage insurance. Your lender is fronting a significant sum of money to allow you to make your purchase. They will seek to protect their investment in the event you become unable to make your payments.

Whenever possible, we recommend putting at least a 20% down payment when buying a house. It will make your monthly payments smaller and you’ll pay less interest. Plus, you’ll save money because you won’t need mortgage insurance. Insurance tax can seem a bit complicated. You can finance the premium through your mortgage, but you need to pay the tax upon your closing date.

How can you get the best value when searching for a home? Here are a few ideas to consider:

- Should You Look At Listings In A Termite Zone?

- Buying an Older Home? Here Are The Red Flags To Watch Out For

- Home Buying Myths Busted: What Really Saves You Money

Moving Costs

Moving expenses may not technically be considered “closing costs,” but there is no getting around them. Hiring professional movers may cost a little more upfront, but will save you a lot of trouble and stress, not to mention reduce your chance of potential injuries. Most moving companies also offer some level of insurance, which covers you if any of your belongings are damaged in the process.

If you decide to recruit family and friends instead of professional movers, there are still some intangible costs involved – beyond the price of pizza. You may have to take time off work, and the heavy lifting could mean a few days of being stiff and sore. Plus, you may need to invest in quite a few boxes and an abundance of bubble wrap.

Setting aside at least 1.5 to 3% of the total purchase price will help to ensure you can comfortably handle all of your closing costs along with any other incidentals that come up. The more you can cushion your budget, the easier it will be to settle into your new home.

If you have any questions about closing costs when buying a house, feel free to contact us at info@gowylde.ca or call 519-826-7109.